Tax Law Attorneys

We help you resolve tax issues, optimize your tax burden, and defend you during audits, inspections, and tax litigation.

Schedule a Consultation

Fill out the form:

Tax Law Attorneys

We support you in solving tax problems, reducing your tax load, and standing by your side in audits and tax proceedings.

Senisse Abogados

Schedule a Consultation

Senisse Abogados

Tax Lawyers

Having trouble justifying your assets?

Uncertain about properly deducting your expenses?

Not sure which tax regime is best for your business?

Facing audits, summons notices, or enforced collections?

Our Tax Attorney

Yrving Feria

Director of the Tax Law Department

Yrving is a consulting attorney and head of the Tax Law Department at Senisse Abogados – Lima office. He graduated from the National University of San Marcos and has over 8 years of experience in providing tax advice to individuals and companies. His professional practice focuses on tax advisory and planning, as well as participation in tax-related procedures.

Yrving Feria

Director of the Tax Law Department

Yrving is a consulting attorney and head of the Tax Law Department at Senisse Abogados – Lima office. He graduated from the National University of San Marcos and has over 8 years of experience in providing tax advice to individuals and companies. His professional practice focuses on tax advisory and planning, as well as participation in tax-related procedures.

Schedule a Consultation

Available for Virtual or In-Person Appointments

Don’t let tax problems affect your business, financial stability, or future projects.

Talk to an expert

Schedule a Consultation

Fill out the form:

Benefits of the

Initial Consultation

- We assess your tax situation and provide a diagnosis with personalized strategies.

- We answer all your questions regarding tax regimes, audits, and tax obligations.

- The meeting lasts approximately one hour, but we make sure you clearly understand the next steps.

- If we’re unable to represent you, we’ll guide you toward the best possible solution.

Our Areas of Expertise

in Tax Law

- Tax Planning and Formalization

- Comprehensive advisory services for structuring companies’ tax situations

- Selection of the most appropriate tax regime

- Tax optimization strategies

- Tax Consulting and Defense

- Support during SUNAT audits (full or partial)

- Defense in tax litigation proceedings

- Preparation and filing of administrative appeals

- Asset support and justification

- Handling of summons notices and pre-assessment letters

- Municipal Taxation and Non-Residents

- Advisory on municipal taxes (public services, property, and transfer taxes)

- Taxation of companies and individuals not domiciled in Peru

- Tax Collection and Regularization Strategies

- Tax installment agreements and tax debt management

- Review and optimization of VAT withholding, perception, and detraction systems

- Enforced collections and strategies to prevent asset seizures

95% of cases

won.

24/7 Availability for

Urgent Cases.

Over 25 Years of

Experience.

Why Trust

Senisse Abogados?

- We work exclusively with tax law specialists who have proven experience.

- Our attorneys have experience defending complex cases, including contentious proceedings and enforced collections.

- We have the technical and strategic expertise to handle audits and litigation with SUNAT.

- We understand the importance of responding quickly and effectively to requirements and notifications from SUNAT or other entities.

- We provide comprehensive advisory services to small and medium-sized businesses (SMEs) and microenterprises for tax planning and optimization.

- We design solid strategies based on tax analysis, evidence building, and the use of appropriate technical mechanisms.

- We work exclusively with proven, experienced tax law specialists.

- We have the technical and strategic expertise to handle audits and litigation with SUNAT.

- We provide comprehensive tax planning and optimization advice to small, medium-sized businesses, and microenterprises (SMEs).

- Our attorneys have experience defending complex cases, including contentious proceedings and enforced collections.

- We understand the importance of responding quickly and effectively to requests and notifications from SUNAT or other entities.

- We design solid strategies based on tax analysis, evidence development, and the use of appropriate technical mechanisms.

Frequently

Asked Questions

What is a tax attorney?

A tax attorney is a specialist in tax and fiscal law, with training in tax legislation and experience in advising individuals and companies. Their main role is to ensure regulatory compliance, optimize the tax burden, and provide defense in audits, administrative procedures, and litigation with SUNAT.

What is the advantage of consulting your case with a tax attorney?

A tax attorney has the technical and strategic knowledge to advise you on matters such as supporting operations, asset justification, expense deductions, and tax optimization. In addition, they can represent you in cases of audits or litigation with SUNAT and other entities, reducing risks and avoiding unnecessary penalties.

Good tax advice prevents legal and financial issues, ensuring that your business operates within the regulatory framework and takes advantage of tax benefits according to its tax regime.

What does a consultation with the specialist involve?

The initial consultation is an in-person or virtual meeting lasting approximately one hour, during which our specialist will analyze your case, identify risks and opportunities, and provide you with a clear strategy to resolve your tax situation. You will also be informed of the firm’s fees in case you decide to hire our services for your defense or tax planning.

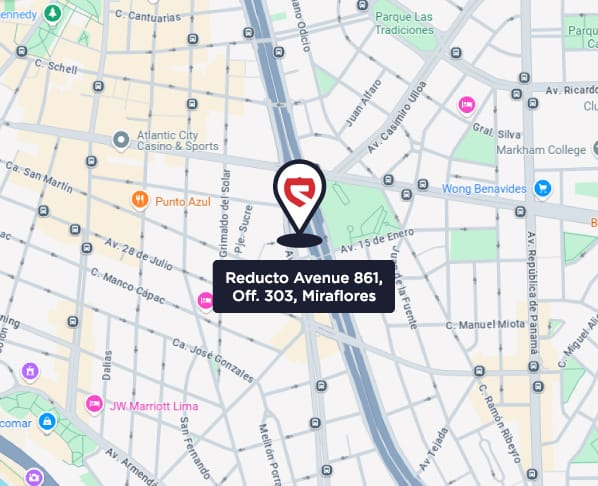

Do you have physical offices?

Yes, our offices are located at Avenida Reducto 861, in the district of Miraflores – Lima – Peru. All attorneys are available for in-person or virtual consultations by appointment.

How do I schedule an appointment?

- First, contact our customer service department at 905 452 024.

- Provide your name and briefly explain your case so the coordinator can determine which specialist should assist you and the available date and time for the consultation.

- Follow the payment instructions to reserve your consultation.

- Send a screenshot of the payment.

- The coordinator will inform you how to attend your consultation.

How can I find out the fees for Senisse Abogados to take my case?

You must go through a consultation with the specialist attorney, as the fees are determined based on the complexity of each case and the amount of work and time the legal team will need to achieve the committed objectives in your case.

What happens if I cannot attend my appointment?

Everything is fine; inform the coordinator at least 12 hours before your appointment through our service number so they can reschedule your appointment.

What happens if I have additional questions after my consultation?

We take care of all your questions. If after the consultation you still have doubts related to the case discussed and you have not yet hired other services from Senisse Abogados, we can continue assisting you through our digital channels to ensure the explanation provided is as clear as possible.

What happens if my case needs to be evaluated by more than one specialist?

In many cases, our clients’ issues are not only criminal, civil, or labor-related; often, it is a mix of several areas such as collections and criminal, labor and criminal, or family and real estate. In all these cases, our coordinator will inform you that during your consultation you may be attended by more than one specialist so that you have a complete overview.